UK Pension and Savings Statistics

Workplace Pensions

Number of Pensions

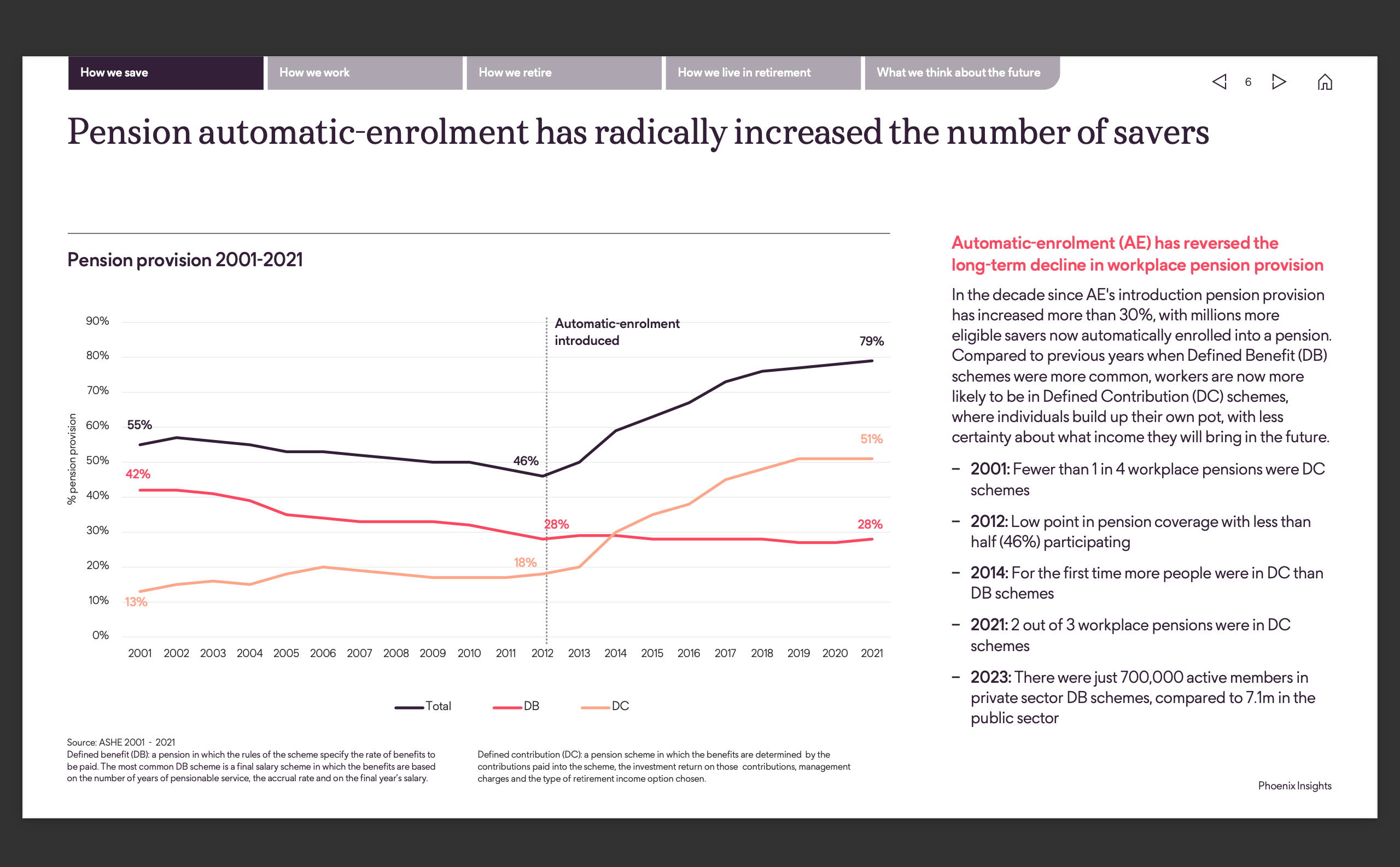

2021: 2 out of 3 workplace pensions were in DC schemes

2023: There were just 700,000 active members in private sector DB schemes, compared to 7.1m in the public sector

So it was 7.8m total DB pensions as of 2023. The total number of workplace pensions was 7.8m / 28% * 79% = 22m.

AUM

Recent figures suggest the UK pensions market assets are just over £3 trillion – split £1.5triliion in DB schemes, workplace DC c£0.7trillion, Sipps £0.6 trillion and Local government pension schemes £0.4 trillion.

Personal Pensions

Number of Pensions and AUM

Recent (2024) FCA figures have confirmed that are 5.3m SIPPs with assets of c £570bn. Over two -thirds of those SIPPs are non-advised. Roughly 2m of those SIPPs are provided by 14 life companies. 19 investment platforms provide c 1.55m SIPPs and 51 specialist SIPP operators also provide around 1.55m SIPPs. The remaining 200,00 SIPPs are provided by a few wealth managers, advisers and other firms.

ISAs

24 million savers (Chart 7) with 725 billion GBP AUM (Chart 3) as of 2023.

Conclusion

Workplace pension:

DB: 7.8m savers, 1.9 trillion GBP, 243,000 GBP each;

DC: 14.2m savers, 700 billion GBP, 49,000 GBP each.

SIPP:

5.3m savers, 570 billion GBP, 107,000 GBP each.

ISA (Cash, Stocks and Shares, etc):

24m savers, 725 billion GBP, 30,200 GBP each.