Brazil's payment system

Brazil’s experience in modernising the payment system to increase efficiency and reduce risks https://www.bis.org/publ/plcy04n.pdf

Retail Payment Systems in Brazil https://www.cemla.org/forodepagos/pdf/week2005/ppt-marciano.pdf

Introducing the Brazilian payment system

The main payment instruments and networks in Brazil are:

- cash

- cheques

- credit cards

- debit cards

- bloquetos de cobranca (bar-coded remittance documents used to pay bills)

- documentos de credito (DOCs, used to make interbank credit payments)

- automated teller machines

- home banking (including through the World Wide Web); and

- smart cards (only pilot projects).

Factors affecting the payment system

The principal factors affecting the Brazilian payment system are:

- the low proportion of consumers with cheque accounts compared with that in developed countries

- the large size of the country and its many areas of difficult access. The country has a vast territory (8.5 million square kilometers), and some areas, such as the Amazon forest region or remote towns and villages in the countryside, have a poor telecommunications infrastructure and insufficient transportation facilities. Nonetheless, it is quite an accomplishment that no cheque takes more than six working days to be cleared (except in a very few remote areas). The country is divided into 32 regions for cheque clearing purposes. Cheques drawn and presented in some of these regions (a number of which are larger than some European countries) are cleared in 24 hours;

- all interbank settlements are made through central bank reserve accounts (because there is a regulatory restriction that prohibits banks from holding balances with each other);

- the post office service, unlike in other countries, is not widely used for financial transfers;

- cooperation between payment system participants, especially in checque processing and transportation;

- the large number of banks, which necessitates a highly developed interbank clearing and settlement system, and a highly developed securities market; and

- a highly concentrated banking industry.

Framework for the Brazilian payment and settlement system

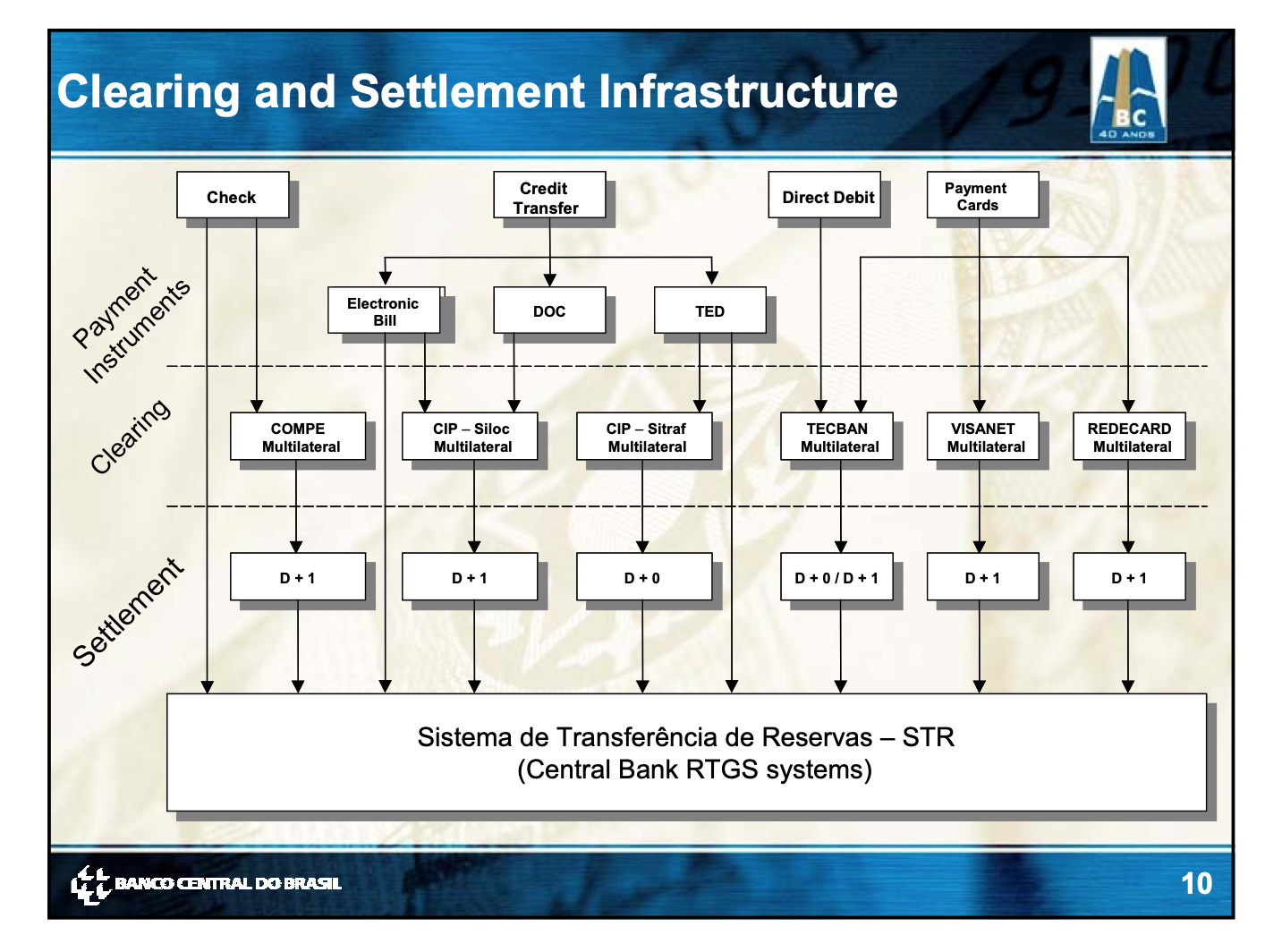

The Brazilian payment system has many specialised systems for clearing and settlement. All these systems are connected to the central bank’s mainframe computer (SISBACEN), which provides 24-hour access. Since financial institutions are not allowed to hold balances with each other, the central bank provides interbank settlement services for all payments. It functions as a settlement agent since the fianncial settlement of all transactions is made against the banks’ reserve accounts at the central bank.

Our main clearing and settlement systems are:

- SELIC (Special System of Custody and Liquidation of Federal Securities) - an electronic system controlled by the central bank, which registers transactions and maintains in book-entry form federal bonds and bills issued by the central bank and the Treasury. It also maintains some state and local government securities. SELIC settles on a net basis;

- CETIP (Central Custody and Financial Clearing of Securities) - a private securities trading and transfer system. It also provides settlement for stock and futures exchange trading and deals in public securities issued by states and local governements. CETIP also settles on a net basis;

- COMPE - a system in which cheques, DOCs and bar-coded remittance documents are cleared. Almost 98% of the total value of these documents is processed electronically;

- EXCHANGE SYSTEM - an electronic system controlled by the central bank whose transactions are input by the institutions directly into SISBACEN. Each operation is individually settled;

- SISBACEN (Central Bank Information System) - this system provides 24-hour access to a vast amount of information produced by the central bank and operates currency exchange transactions with selected dealers in the domestic market. The system has links to both national (SELIC, CETIP) and international (SWIFT, CHIPS) systems.